Since Canada may fall short in its emissions goal, Zehan Li & Catherine Su pose the question - How can Canada act urgently yet carefully with change and what can be learned from others?

How is Canada’s transition going?

In 2023, the Canadian Climate Institute concluded even with generous assumptions, Canada will still fall short of their 2030 emissions goal. Industries like transportation and manufacturing rely heavily on fossil fuels, and technological changes have been slow. However, the situation is not without hope. Over 80% of Canadian electricity is non-emitting; it is clear that Canada has the technology to scale and implement nationwide use of renewable energy. In 2023, the Canadian Ministry of Just Transition was created to ensure that the phase-out of oil and gas would coincide with stable energy prices and job markets. However, being careful must not warrant being indecisive.

For a just transition, both the supply and demand of fossil fuels must be curbed simultaneously. This creates a chicken-and-egg dilemma that the Canadian government has struggled to solve. Canada remains a top 5 oil consumer, producer, and exporter globally. Domestic demand continues to increase yearly. Sustainable aspirations conflict with reality’s market equilibrium, and trying to manage the need for oil has led to conflicting policies. Examples of this can easily be seen in Canada through the debates regarding the impact of the Green Transition on the Albertan economy and the wealth fossil fuels such as liquefied natural gas could bring to Canada.

On the business side, Big Oil faces the same dual challenge. Big Oil companies are necessary evils, profiting off mass emissions while holding the biggest key to the green energy transition. They have been one of the greatest opposers to sustainability efforts through lobbying, redirection, and greenwashing. However, Big Oil is also leading change through heavily investing in “just” transition plans. More than a fifth of VC investments into climate tech in 2022 came from oil and gas companies. Chevron, one of the world’s largest oil and gas companies, recently launched their third fund with commitments of $10 billion in carbon reduction investments by 2028. Conversely, Chevron’s climate pledge was declared “worthless” by a transnational watchdog. We regularly see greenwash reports and abandoned projects from Big Oil, and the trouble is that it is unclear whether their efforts are genuine or merely performative. Regardless, the resources, technology, and lobbying power are in the hands of Big Oil, and the transition will occur when it is “just”. Stakeholder theory has been insufficient to disrupt energy; regulations and markets must enable and direct change. Persuading Big Oil to change- whether through incentives or force -is the key to make or break the Green Transition.

Green Carrots and Sticks Around the World - China and Norway

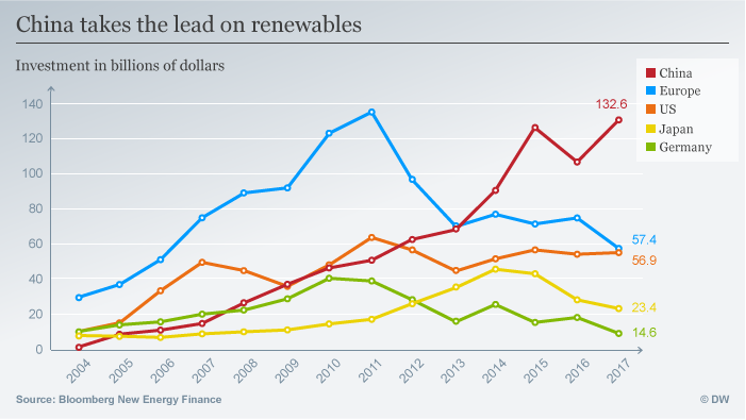

In recent years, China has pursued an extraordinarily ambitious transition in hopes of being the world’s leading provider of renewables. Green energy is seen as the key to their international economic and political strength. China already has 80% of the global solar infrastructure market, and their three-pronged focus in solar cells, lithium batteries, and EVs drove their staggering $890 billion USD in renewable energy investments in 2023.

It is a declaration of dominance in renewables, but China now faces new troubles. Biden has maintained Trump’s high tariffs on Chinese solar imports, and the ongoing EU probe into Chinese EVs pose new obstacles. Additionally, China must also face their growing real estate crisis. Declines in real estate investment don’t show signs of stopping, and many of China’s largest developers are defaulting and liquidating.

The question of how to prioritize attention and assets in China will only grow more tense; domestic and international headwinds are strong, and it goes to show that mere commitment and steadfastness are just not enough.

Despite being Europe’s leading oil producer, Norway has made remarkable progress in emissions reduction. Norway’s government began implementing green policies and carbon taxes in 1990; as of 2020, their emissions per capita are below 1990 levels, and their total emissions will soon hit the same milestone.

Achieving these goals has come from a revolution in transportation. Over 80% of cars sold in Norway are EVs, and they are aiming for 100% by 2025. EV owners enjoy numerous green tax breaks from typical purchase, import, road, and VAT taxes–over 25% in savings. Additionally, Norway has continually invested in infrastructure to support progress. In scaling up municipal EV charging programs since 2008, the government has ensured charging stations exist nationwide, ensuring that their investments have adapted to their policy over the course of a 30-year initiative. In Canada, economic reliance on oil has stifled our transition to EV, so what made Norway different? With 10% of national fossil fuels coming from personal vehicular emissions, answering this question is crucial for Canada to become carbon neutral.

What’s Next for Canada?

This brings us back to Canada’s transition, posing the question of how we can be urgent yet careful with change. While in the one-party state of China, economic outcomes rule all else, electoral politics greatly influence policy in Canada, and it can mean abrupt changes in priorities. This can make long-term initiatives difficult to see through. There may be no clear answer as to how Canada should restrict or redesign the limits of the energy industry, but they should begin by strictly ensuring Big Oil plays by the existing rules. This means punishing greenwashing, validating carbon credits, and tracking the impact of green capital and investments. For the first decade of Norway’s green policies beginning in 1990, their emissions continue to rise; it is extremely difficult to get a transition off the ground, especially when the most influential players are able to dance around the issue.

Like China, Canada must manage the Green Transition amidst a housing crisis. The newest Federal Budget revealed a focus on housing funded with increased capital gains taxes. These taxes deter the startup investment space, and the government will need to find a way to compensate. One option is for large scale sandbox programs and accelerators for cleantechs seeking solutions in carbon capture, EV manufacturing, and electrification. Alternatively, the government could bear greater responsibility with their own initiatives. With EV charger developments, the government could take over the work of private companies such as Tesla and Flo, preventing the space from potentially being controlled and slowed by traditional energy providers. Regardless of the direction, Canada’s leadership must take decisive action before it is too late. 2030 is less than 6 years away, and Canada’s Green Transition is still finding its stride. The energy policies decided now will drive our future towards global sustainability.

Bibliography

“big oil” bankrolls more climate VC deals, a dilemma for founders | Pitchbook. (n.d.). https://pitchbook.com/news/articles/big-oil-climate-tech-cvc-amogy-aramco

DiLallo, M. (2024, April 19). Chevron the venture capitalist: The Oil Giant is pumping $500 million into the future of Energy. The Motley Fool. https://www.fool.com/investing/2024/04/19/chevron-the-venture-capitalist-the-oil-giant-is-pu/

Federal budget 2024: Summary and analysis, CUPE National Research. Canadian Union of Public Employees. (n.d.). https://cupe.ca/federal-budget-2024-summary-and-analysis-cupe-national-research

Myllyvirta, L. (2024, February 15). Analysis: Clean energy was top driver of China’s economic growth in 2023. Carbon Brief. https://www.carbonbrief.org/analysis-clean-energy-was-top-driver-of-chinas-economic-growth-in-2023/

Team, T. W. (2024, January 23). How did Norway become the global leader in EV adoption?. New. https://blog.wallbox.com/how-norway-became-a-global-ev-leader/

Xiaoying, Y. (2023, November 16). The “new three”: How China came to lead solar cell, lithium battery and EV manufacturing. Dialogue Earth. https://dialogue.earth/en/business/new-three-china-solar-cell-lithium-battery-ev/

About the Authors

Zehan Li is a student at Ivey Business School pursuing a dual degree with PPE (Politics-Philosophy-Economics) and Business. During his HBA1 year, he researched greenwashing with Dr. Wren Montgomery while examining environmental economics data with Dr. Nouri Najjar. He hopes to work in the sustainable startup field and wants to explore what incentives and policies are needed for change to happen.

Catherine (Cassie) Su is a student at Ivey Business School pursuing a dual degree with PPE (Politics-Philosophy-Economics) and Business. She is interested in exploring how ESG policies affect business health and their effectiveness in creating real, impactful change.

___

Disclaimer: The views expressed in this blog are those of the authors and do not necessarily reflect the official position of the Centre.