Whether managing the Great Depression or saving a bank from state hands at the height of the euro zone debt crisis in 2011, there are valuable investing lessons from history.

Two keynote speakers from the Ben Graham Centre 2014 Value Investing Conference in Toronto on April 8 shared such lessons as they spoke about two historical periods.

Related to this story

Amity Shlaes: The model of the 1920s and how a Scrooge made an impact

Shlaes, Forbes columnist and author of Coolidge, a biography of the U.S.’s 30th president, Calvin Coolidge, discussed how Coolidge’s “Scrooge-like” approach to managing the U.S. in the 1920s paid off. In the same way, value investors are often successful by holding out for assets at significant discounts.

Although debt and unemployment rates were high and there were pressures from farmers and war veterans for subsidies, Coolidge wouldn’t spend. Instead, he let markets naturally correct themselves over time.

“It is possible for a U.S. leader to say no to spending and not hurt the economy,” she said. “Coolidge was a budget man and he had a different temperament. If he was a stock, he’d be a value stock. He would be a good buy.”

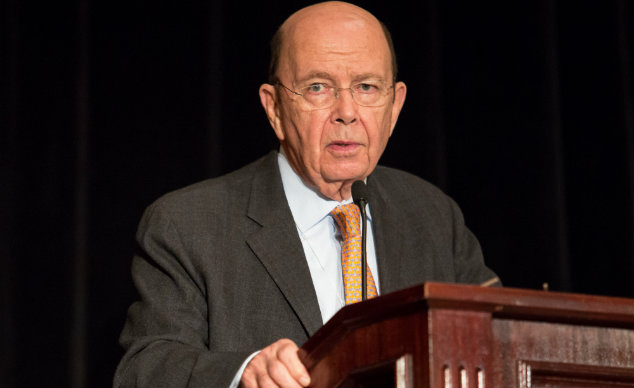

Wilbur Ross: Lessons from the Bank of Ireland Saga

Ross, CEO of WL Ross & Co. LLC, was one of the foreign investors, along with Fairfax Financial Holdings, Fidelity Investments, Capital Group, and Kennedy Wilson, to take a stake in the Bank of Ireland during the Irish banking crisis. He discussed lessons learned from distressed debt investing:

- The more complex the situation is, the less chance there is of competitors bidding up the price;

- You don’t necessarily get paid for taking risk;

- You have to have a good implementation plan;

- It is tricky working with governments, but in times of adversity, you can negotiate a sensible transaction;

- Timing is everything. The earlier you come into a deal, the more danger that your price of entry will be too high or that you won’t have all the facts.

“It’s virtually impossible to pick the exact bottom, but in general, I’d rather get in a little later and pay a bit more for higher quality data points,” he said.

The conference also included panel sessions with value investing professionals and corporate executives. Here are the highlights of those panel discussions:

Mohnish Pabrai: Be a shameless cloner

Pabrai, Managing Partner of Pabrai Investment Funds, discussed the ideal size of an investment operation. He said he prefers to work alone because having a big team adds another layer to manage. But since no investment manager can analyze the more than 50,000 stocks available, he suggests following the 13Fs, a quarterly report of equity holdings by investment advisers, and other investors’ recommendations and copying their ideas.

“If you bowl, there are two ways to operate: with bumpers or without bumpers. What matters in the end is getting the highest score. If you bowl with bumpers you’ll get a better score because you don’t get the gutter balls. Cloning is the same,” he said. “If you look at the 13Fs and then add your own analysis, the error rate goes down.”

James B. Rosenwald III: Have skin in the game

Rosenwald III, Senior Portfolio Manager for Asian Equities Strategies, Dalton Investments, stressed the importance of investment companies’ interests being aligned with those of shareholders. One way is for investment advisers to have “skin in the game”, or risk their own money in the investment alongside the client. His team at Dalton is required to put half of pre-tax bonuses back into the fund.

“Having skin in the game ensures my team’s interests are aligned with my clients’ interests,” he said. “If you have five times your salary invested in the fund, you think like the owner of the company.”

George Chryssikos: Don’t ignore the fundamentals

Chryssikos, CEO, Executive BoD Member and Chair of the Investment Committee of Eurobank Properties, discussed his company’s success in adhering to value investing tenets. After the company was acquired by Fairfax Financial Holdings Ltd. in August 2012, he saw how cost-cutting measures, such as doing work within rather than outsourcing, picked up the ailing company during the recession in Greece. Now Eurobank focuses on buying assets at discounts, such as distressed properties.

“Never ignore the fundamentals. Have a clear strategy and solid orientation to value investing principles,” he said. “Transparency is also important. Try to find companies and managers who have nothing to hide.”

The annual Ben Graham Centre Value Investing Conference is the largest conference of its kind in Canada and aims to explain, discuss and debate the principles, practices and various applications of value investing from a global context.

Value Investor panel:

Mohnish Pabrai, Managing Partner of Pabrai Investment Funds; Irwin A. Michael, President of I.A. Michael Investment Council Ltd.; Richard Lawrence, Jr., Chairman and Executive Director, Overlook Investments; James B. Rosenwald III, Senior Portfolio Manager for Asian Equities Strategies, Dalton Investments; Srinivas Pulavarti, President and Chief Investment Officer, UCLA Investment Company.

Corporate Executive panel:

George Chryssikos, CEO, Executive BoD Member and Chair of the Investment Committee of Eurobank Properties; Murray Edwards, President & Owner, Edco Financial Holdings Ltd.; Bruce Flatt, CEO, Brookfield Asset Management Inc.

Wilbur Ross,CEO of WL Ross & Co. LLC