Your CPA, Your Career, Your Advantage.

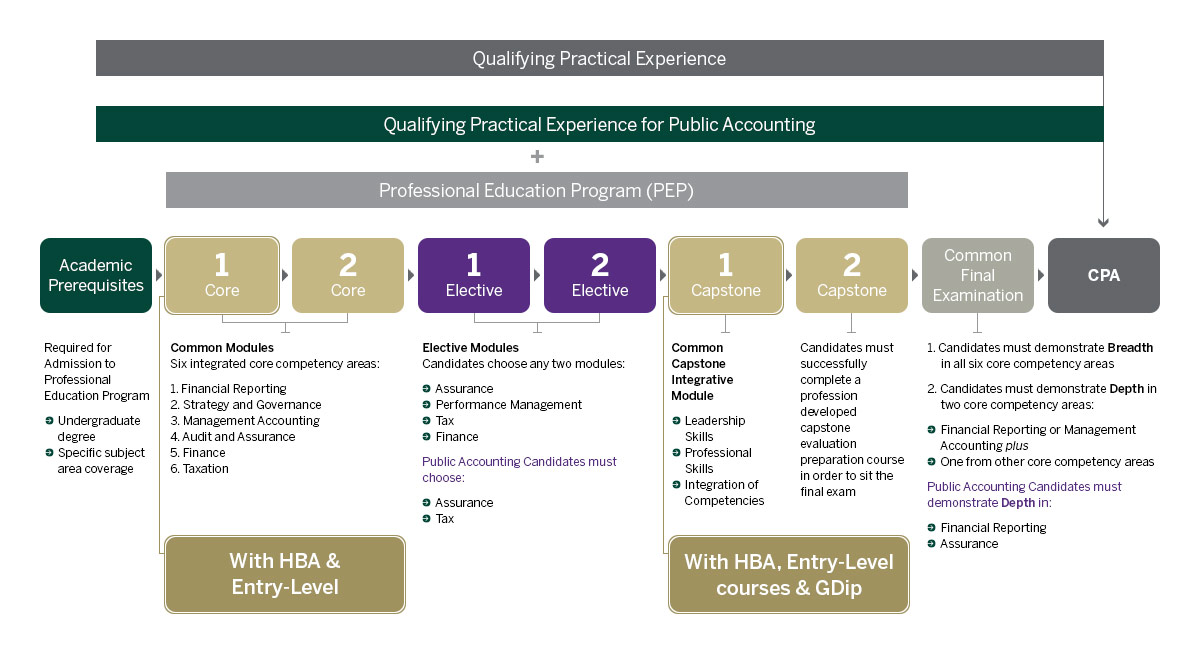

To become a CPA, students must complete four steps: (1) prerequisite education, (2) the CPA Professional Education Program (PEP), (3) the Common Final Examination (CFE), and (4) practical experience. Learn more via Prospective Students.

Ivey’s HBA, combined with the CPA Ontario-accredited Ivey stream of the Western Graduate Diploma in Accounting (GDip Accounting), offers advanced standing in the CPA PEP. With the GDip, Ivey HBAs are exempt from the two Core and two Elective PEP modules, including the exams, and only need to complete the two Capstone Modules before writing the CFE. See Advanced Standing below.

Alternatively, Ivey HBAs can meet the prerequisite education requirements through specific HBA courses plus one advanced financial accounting course, then begin the CPA PEP from the start. See Entry Level below.

Entry Level

To enter the CPA Professional Education Program (PEP), candidates need an undergraduate degree and specific prerequisites. Ivey’s undergraduate program satisfies all but one of these through required and elective courses, plus an accounting add-on. Students must achieve a 70% average and at least 60% in each course. By completing these, along with one advanced financial accounting course, Ivey HBA graduates meet the CPA PEP entry requirements.

Advanced Standing

Since Ivey’s CPA program is accredited by CPA Ontario, Ivey HBA students may complete the Graduate Diploma in Accounting (GDip Accounting) and receive advanced standing into the CPA Professional Education Program (PEP). With the GDip Accounting, Ivey students are exempt from the two Core modules and the two Elective modules, including the related examinations. Students must only complete the two Capstone modules prior to writing the Common Final Examination (CFE).

Course Timeline

The Ivey GDip Accounting runs for approximately 13 weeks each year from May to the end of July. The program consists of five courses:

- Advanced Audit

- Advanced Corporate Financial Reporting

- Advanced Taxation

- Risk, Control and Governance

- An Integrated Approach to the Competencies

Students must achieve an overall average of 72% across the entry-level courses (excluding BUS 2257) for admission to the Ivey GDip Accounting Program.

Elective Areas

Ivey’s HBA in combination with the Ivey stream GDip Accounting offers the necessary courses for students to choose any of the four elective areas of the CPA PEP:

- Assurance

- Performance Management

- Taxation

- Finance

Public accounting candidates must choose the Assurance and Taxation electives.

Helpful Links

Chartered Professional Accountants of Ontario (CPA Ontario)

CPA Ontario’s website provides specific information pertaining to the CPA designation in Ontario, including information for students in legacy CA programs.

Chartered Professional Accountants of Canada (CPA Canada)

The CPA Canada website provides information on the new Chartered Professional Accountant (CPA) designation, the qualification process and the progress on unification of the provincial accounting bodies.